Understanding Bank of America: Its Journey and Presence in Today's Market

History of Bank of America

Bank of America, often abbreviated as BofA, began its journey more than a century ago. Its roots can be traced back to the early 1900s with the establishment of the Bank of Italy in San Francisco by Amadeo Giannini. Aimed initially at serving immigrants denied services by other banks, it quickly grew. Following a series of expansions and mergers, the most notable being with NationsBank in 1998, the enterprise eventually came to be known as Bank of America Corporation.

Core and Side Businesses

The core business of Bank of America involves a wide range of financial services including personal banking, loans, mortgages, investment services, and credit cards. It operates through various segments such as Consumer Banking, Global Wealth & Investment Management (GWIM), Global Banking, and Global Markets.

Besides its main financial operations, Bank of America also engages in side businesses that complement its primary activities. These include insurance services, investment management for institutional investors, and transaction services. Moreover, the firm is involved in philanthropy through the Bank of America Charitable Foundation, investing in social causes and community development.

Current Market Status

As of now, Bank of America stands as one of the largest banking institutions in the United States and a significant player globally. It serves millions of customers through a vast network of branches and ATMs across the U.S. and in international markets. The bank has embraced digital banking, with a strong focus on mobile and online services to meet the evolving needs of its customers.

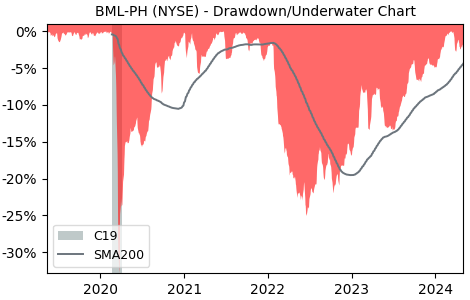

Financially, Bank of America has shown resilience and growth, continuing to strengthen its market position. Its stock, listed under the ticker symbol BML-PH, is actively traded and reflects investor confidence in the bank's stability and future prospects. Despite challenges in the banking sector, Bank of America's diverse range of services and global reach position it well to navigate the complexities of the financial landscape.