CTA-PB - E. I. du Pont de Nemours and - Stock & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Preferred Stock • ISIN: -s

Seeds, Crop Protection Products, Herbicides, Insecticides, Fertilizers

EIDP, Inc., a leading agriculture company, provides innovative solutions to farmers and the agriculture industry across the globe, including the United States, Canada, Europe, the Middle East, Africa, Latin America, and the Asia Pacific.

The company operates through two primary segments: Seed and Crop Protection. The Seed segment offers a diverse range of products, including corn, soybean, and other oil seeds, as well as trait technologies that enhance resistance to weather, disease, insects, and herbicides. These technologies help farmers control weeds and improve crop yields. Additionally, the segment provides digital solutions that assist farmers in making informed decisions, and develops advanced germplasm and traits that produce higher yields.

The Crop Protection segment serves the agricultural input industry by providing products that protect crops from weeds, insects, and diseases, and enhance overall crop health. The segment's product portfolio includes herbicides, insecticides, nitrogen stabilizers, and pasture and range management herbicides. These products help farmers manage weeds, pests, and diseases, and improve crop health above and below ground through nitrogen management and seed-applied technologies.

EIDP, Inc. has a rich history, dating back to 1802, and is headquartered in Indianapolis, Indiana. The company was formerly known as E. I. du Pont de Nemours and Company and changed its name to EIDP, Inc. in January 2023. Today, EIDP, Inc. operates as a subsidiary of Corteva, Inc., a leading agriculture company. For more information, visit their website at https://www.corteva.com.

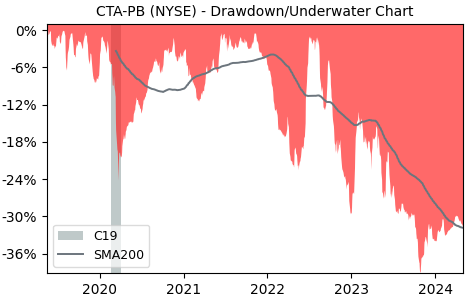

Drawdown (Underwater) Chart

CTA-PB Stock Overview

| Market Cap in USD | 70,882m |

| Sector | Basic Materials |

| Industry | Agricultural Inputs |

| GiC SubIndustry | Diversified Metals & Mining |

| TER | 0.00% |

| IPO / Inception |

CTA-PB Stock Ratings

| Growth 5y | -15.7 |

| Fundamental | 12.5 |

| Dividend | 56.9 |

| Rel. Performance vs Sector | -0.46 |

| Analysts | - |

| Fair Price Momentum | 87.22 USD |

| Fair Price DCF | 7.91 USD |

CTA-PB Dividends

| Dividend Yield 12m | 5.84% |

| Yield on Cost 5y | 5.05% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 94.7% |

CTA-PB Growth Ratios

| Growth 12m | 26.28% |

| Growth Correlation 12m | 82.5% |

| Growth Correlation 3m | 91.6% |

| CAGR 5y | -2.97% |

| CAGR/Mean DD 5y | -0.19 |

| Sharpe Ratio 12m | 1.08 |

| Alpha vs SP500 12m | 4.58 |

| Beta vs SP500 5y weekly | 0.47 |

| ValueRay RSI | 26.34 |

| Volatility GJR Garch 1y | 18.67% |

| Price / SMA 50 | 1.21% |

| Price / SMA 200 | 9.6% |

| Current Volume | 1.1k |

| Average Volume 20d | 1.1k |

External Links for CTA-PB Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of October 22, 2024, the stock is trading at USD 77.09 with a total of 1,071 shares traded.

Over the past week, the price has changed by -3.18%, over one month by -1.56%, over three months by +10.85% and over the past year by +24.81%.

According to ValueRays Forecast Model, CTA-PB E. I. du Pont de Nemours and will be worth about 95 in October 2025. The stock is currently trading at 77.09. This means that the stock has a potential upside of +23.25%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 95 | 23.2 |