CTLT - Catalent - Stock Price & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US1488061029

Biologics, Vaccines, Pharmaceuticals, Cosmetics, Supplements, Animal Health

Catalent Inc. is a leading global provider of development and manufacturing solutions for a wide range of healthcare products, including drugs, biologics, cell and gene therapies, and consumer health products.

The company operates through two main segments: Biologics and Pharma and Consumer Health. The Biologics segment focuses on the development and manufacturing of biologic proteins, cell and gene therapies, and nucleic acid-based treatments. This includes services such as formulation, development, and manufacturing for parenteral dose forms, as well as analytical development and testing for large molecules.

In addition, the Biologics segment offers specialized services for the development and manufacturing of vaccines, oncolytic viruses, and pDNA, as well as induced pluripotent stem cells (iPSCs). This segment caters to companies working on cutting-edge treatments and therapies, providing them with the expertise and infrastructure needed to bring their products to market.

The Pharma and Consumer Health segment, on the other hand, provides a range of services for the development and manufacturing of soft capsules, oral solid-dose formats, and other dosage forms. This includes clinical supply services, such as manufacturing, packaging, storage, and distribution, as well as pre-clinical screening and formulation development.

One of the unique strengths of Catalent is its ability to offer integrated development and product supply chain solutions, which enable companies to streamline their product development and commercialization processes. The company's FlexDirect direct-to-patient and FastChain demand-led clinical supply solutions are designed to provide flexibility and efficiency in clinical trials and commercial product distribution.

Catalent serves a diverse range of customers, including pharmaceutical, biotechnology, and consumer health companies, as well as companies in the animal health, medical devices, and cosmetics industries. With a rich history dating back to 1933, the company is headquartered in Somerset, New Jersey, and has established itself as a trusted partner for companies seeking to develop and commercialize innovative healthcare products.

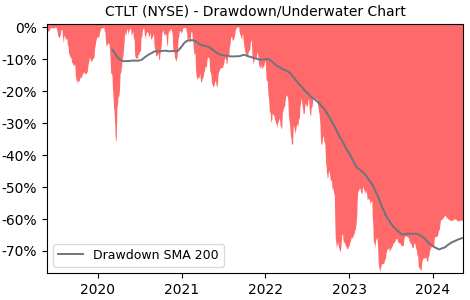

Drawdown (Underwater) Chart

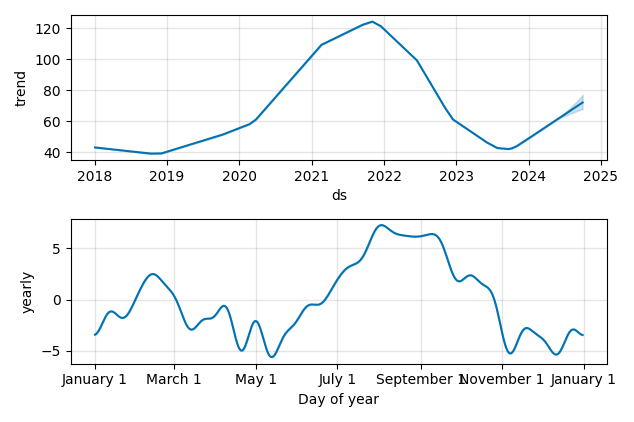

Overall Trend and Yearly Seasonality

CTLT Stock Overview

| Market Cap in USD | 10,227m |

| Sector | Healthcare |

| Industry | Drug Manufacturers - Specialty & Generic |

| GiC SubIndustry | Pharmaceuticals |

| TER | 0.00% |

| IPO / Inception | 2014-07-31 |

CTLT Stock Ratings

| Growth 5y | 3.43 |

| Fundamental | -26.4 |

| Dividend | 0.00 |

| Rel. Performance vs Sector | 0.40 |

| Analysts | 3.25/5 |

| Fair Price Momentum | 54.53 USD |

| Fair Price DCF | 15.44 USD |

CTLT Dividends

| Dividend Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

CTLT Growth Ratios

| Growth 12m | 21.79% |

| Growth Correlation 12m | 45% |

| Growth Correlation 3m | 45% |

| CAGR 5y | 0.79% |

| CAGR/Mean DD 5y | 0.03 |

| Sharpe Ratio 12m | 0.46 |

| Alpha vs SP500 12m | -2.77 |

| Beta vs SP500 5y weekly | 1.24 |

| ValueRay RSI | 77.73 |

| Volatility GJR Garch 1y | 9.53% |

| Price / SMA 50 | 4.39% |

| Price / SMA 200 | 15.08% |

| Current Volume | 3004.9k |

| Average Volume 20d | 1968.9k |

External Links for CTLT Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of July 27, 2024, the stock is trading at USD 58.68 with a total of 3,004,922 shares traded.

Over the past week, the price has changed by +1.33%, over one month by +4.49%, over three months by +4.94% and over the past year by +20.94%.

According to ValueRays Forecast Model, CTLT Catalent will be worth about 59.7 in July 2025. The stock is currently trading at 58.68. This means that the stock has a potential upside of +1.79%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 58.3 | -0.65 |

| Analysts Target Price | 50.9 | -13.2 |

| ValueRay Target Price | 59.7 | 1.79 |