John Bean Technologies (JBT) - Stock & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US4778391049

John Bean Technologies Corporation (NYSE: JBT) is a technology solutions provider catering to the food and beverage industry and offering equipment and services to the air transportation sector on a global scale including North America, Europe, Middle East, Africa, Asia Pacific, and Latin America.

The company operates through two main segments: FoodTech and AeroTech. In the FoodTech segment, JBT offers a wide array of value-added processing solutions ranging from chilling and mixing to cooking and freezing. It specializes in processing equipment and packaging systems for a variety of products like poultry, beef, seafood, fruits, vegetables, and more.

Moreover, JBT provides automated guided vehicle systems for material handling in various facilities and mobile air transportation equipment such as cargo loading and aircraft ground power systems. They also offer airport equipment and maintenance services to airport authorities, airlines, ground handling companies, and defense contractors worldwide.

JBT reaches its customers through various channels including a direct sales force, independent distributors, sales representatives, and technical service teams. Established in 1994, John Bean Technologies Corporation is headquartered in Chicago, Illinois. For more information, you can visit their website at https://www.jbtc.com.

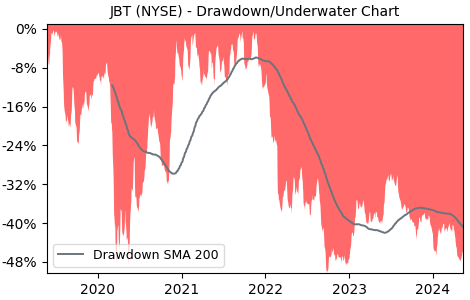

Drawdown (Underwater) Chart

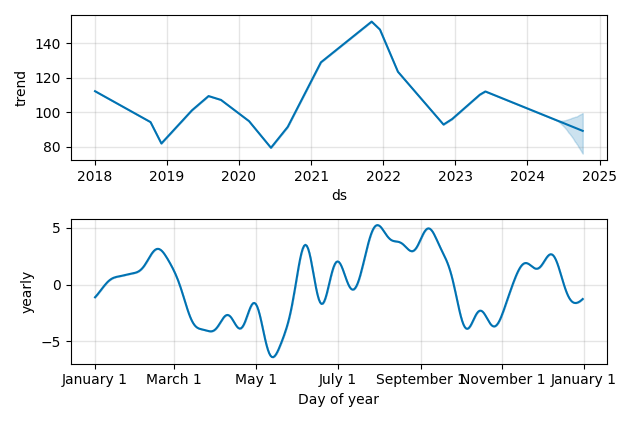

Overall Trend and Yearly Seasonality

JBT Stock Overview

| Market Cap in USD | 2,919m |

| Sector | Industrials |

| Industry | Specialty Industrial Machinery |

| GiC SubIndustry | Industrial Machinery & Supplies & Components |

| TER | 0.00% |

| IPO / Inception | 2008-07-22 |

JBT Stock Ratings

| Growth 5y | -1.45 |

| Fundamental | 27.8 |

| Dividend | 5.06 |

| Rel. Performance vs Sector | -3.90 |

| Analysts | 3.75/5 |

| Fair Price Momentum | 78.60 USD |

| Fair Price DCF | 16.78 USD |

JBT Dividends

| Yield 12m | 0.45% |

| Yield on Cost 5y | 0.40% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 98.2% |

JBT Growth Ratios

| Growth 12m | -19.25% |

| Growth Correlation 12m | -56% |

| Growth Correlation 3m | -40% |

| CAGR 5y | -2.39% |

| Sharpe Ratio 12m | -0.77 |

| Alpha vs SP500 12m | -49.47 |

| Beta vs SP500 5y weekly | 1.34 |

| ValueRay RSI | 14.06 |

| Volatility GJR Garch 1y | 37.94% |

| Price / SMA 50 | -10.27% |

| Price / SMA 200 | -14.38% |

| Current Volume | 341k |

| Average Volume 20d | 270.7k |

External Links for JBT Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of April 26, 2024, the stock is trading at USD 88.61 with a total of 340,999 shares traded.

Over the past week, the price has changed by -1.23%, over one month by -10.28%, over three months by -12.59% and over the past year by -13.20%.

According to ValueRays Forecast Model, JBT John Bean Technologies will be worth about 87.3 in April 2025. The stock is currently trading at 88.61. This means that the stock has a potential downside of -1.51%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 110.3 | 24.5 |

| Analysts Target Price | 123 | 38.8 |

| ValueRay Target Price | 87.3 | -1.51 |