A Glimpse into JPMorgan Chase & Co.

History

JPMorgan Chase & Co., one of the oldest financial institutions, has a rich legacy that dates back over 200 years. Its origins can be traced to numerous banks merging over the centuries, notably J.P. Morgan & Co., The Chase Manhattan Bank, and several others, culminating in the giant known as JPMorgan Chase & Co. today. The combination of these companies has not only created a global powerhouse in financial services but also a robust entity known for its resilience and ability to adapt to changing market dynamics.

Core Business

At its heart, JPMorgan Chase & Co. is a global leader in financial services, providing solutions in investment banking, financial transactions, asset management, and many more areas. The company's core mission is to serve individual consumers, small and medium-sized businesses, as well as large corporations, through a vast array of products and services. This includes offering personal banking, credit cards, loans, and investment products, emphasizing JPMorgan's role in touching every facet of the financial life cycle.

Side Business and Diversification

Beyond its primary operations, JPMorgan Chase & Co. has strategically diversified its portfolio to encompass a wide range of financial services. This includes, but is not limited to, wealth management, treasury services, and market operations. Diversification allows JPMorgan to mitigate risks associated with economic fluctuations, ensuring it remains robust across varying financial landscapes.

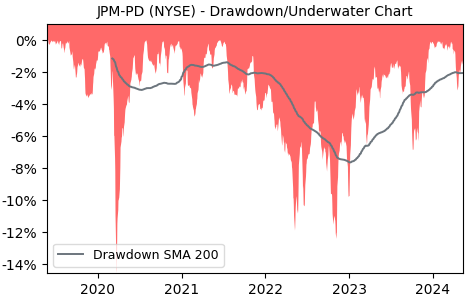

Current Market Status

As of now, JPMorgan Chase & Co. stands as a towering figure in the financial industry, boasting a global presence and a formidable market capitalization. It is one of the largest banks in the United States by assets and continues to exert a significant influence on both Wall Street and global finance. The company has shown resilience in navigating economic challenges, adapting to regulatory changes, and embracing technological innovations to stay ahead. With its strong foundation and strategic approach to growth and diversification, JPMorgan Chase & Co. is well-poised to continue its legacy of success.