Morgan Stanley: From Historical Roots to Modern Financial Giant

History of Morgan Stanley

Morgan Stanley, a name synonymous with global finance, was established in 1935. This was after the Glass-Steagall Act required commercial banks to separate their investment banking activities. Initially a part of J.P. Morgan, the firm spun off to become its own entity, focusing on investment banking. Over the decades, it has grown significantly, playing a crucial role in major financial milestones, including landmark IPOs and mergers.

Core Business

At the heart of Morgan Stanley's operations is its Investment Banking division, which advises on deals, including mergers and acquisitions (M&A), and manages securities offerings. Additionally, Wealth Management is a substantial part of its business, catering to the financial needs of high-net-worth individuals and institutions. These core segments are complemented by Investment Management, which oversees assets across various asset classes for a diversified clientele.

Side Businesses

Beyond its mainstay operations, Morgan Stanley has ventured into areas like research, trading, and sales, providing insightful analysis and market execution capabilities. It has also made strategic enhancements in digital banking and offers a suite of financial services tailored to different customer needs, exhibiting adaptability in a dynamic financial landscape.

Current Market Status

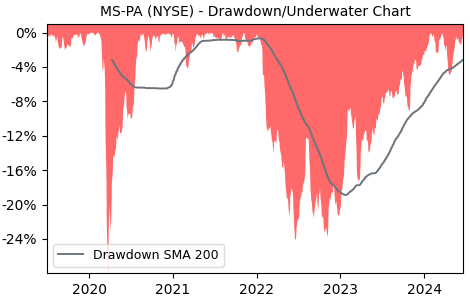

As of the latest information available in 2023, Morgan Stanley holds a formidable position in the global financial market. It has navigated various economic cycles and challenges, including market volatility and regulatory changes. The company's stock, listed as MS on the New York Stock Exchange, reflects its financial health and the confidence investors have in its management and future growth. With its diversified business model and strategic investments in technology and human capital, Morgan Stanley is well-positioned to continue its legacy of success.