ORAN - Orange SA ADR - Stock Price & Dividends

Exchange: USA Stocks • Country: France • Currency: USD • Type: Common Stock • ISIN: US6840601065

Mobile, Telephony, Data, Internet, Broadband, IT, Security

Orange S.A. is a leading telecommunications company that provides a wide range of services to individuals, businesses, and other operators in France and globally. The company's diverse portfolio includes fixed telephony, mobile telecommunications, data transmission, and value-added services.

Orange S.A. operates through several segments, including France, Spain and Other European Countries, Africa and Middle East, Enterprise, Orange Business, Totem, International Carriers & Shared Services, and Mobile Financial Services. This diversified approach enables the company to cater to different markets and customer needs.

The company's mobile services include voice, SMS, and data, as well as fixed broadband and narrowband services. Additionally, it offers B2B fixed solutions and network services, including voice and data services. Orange S.A. also sells a range of devices and accessories, such as mobile handsets, broadband equipment, and connected devices.

Orange S.A.'s IT and integration services are designed to support businesses, offering unified communication and collaboration services, hosting and infrastructure services, including cloud computing, customer relations management, and security services. The company also provides video conferencing solutions and sells related equipment.

Further, Orange S.A. offers national and international roaming services, online advertising services, and mobile virtual network operators. It also provides network sharing and mobile financial services, and sells equipment to external distributors, brokers, and operators.

With a strong brand presence, Orange S.A. markets its products and services under the Orange brand. The company has a rich history, having formerly been known as France Telecom before changing its name to Orange S.A. in July 2013. Today, Orange S.A. is headquartered in Issy-les-Moulineaux, France, and can be accessed online at https://www.orange.com.

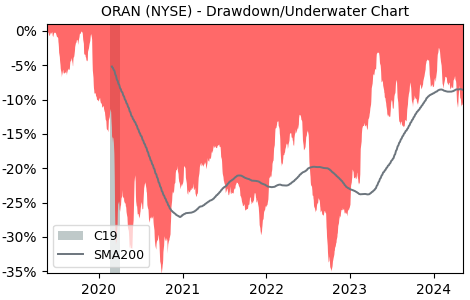

Drawdown (Underwater) Chart

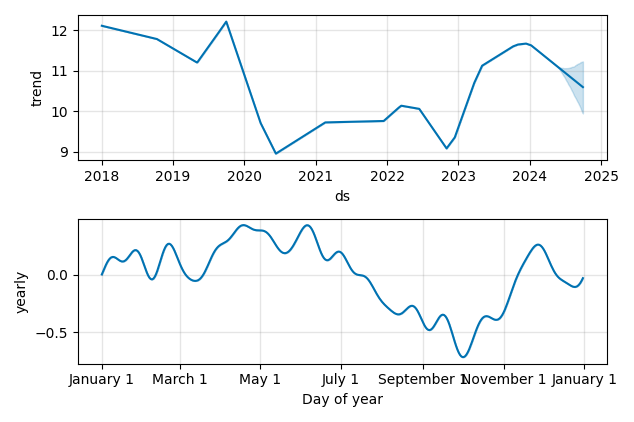

Overall Trend and Yearly Seasonality

ORAN Stock Overview

| Market Cap in USD | 29,954m |

| Sector | Communication Services |

| Industry | Telecom Services |

| GiC SubIndustry | Integrated Telecommunication Services |

| TER | 0.00% |

| IPO / Inception | 1997-10-09 |

ORAN Stock Ratings

| Growth 5y | 9.71 |

| Fundamental | 34.3 |

| Dividend | 48.2 |

| Rel. Performance vs Sector | -1.24 |

| Analysts | 4.50/5 |

| Fair Price Momentum | 11.09 USD |

| Fair Price DCF | 52.05 USD |

ORAN Dividends

| Dividend Yield 12m | 6.97% |

| Yield on Cost 5y | 7.16% |

| Dividends CAGR 5y | -0.54% |

| Payout Consistency | 87.2% |

ORAN Growth Ratios

| Growth 12m | 4.47% |

| Growth Correlation 12m | 8% |

| Growth Correlation 3m | -3% |

| CAGR 5y | 0.52% |

| CAGR/Mean DD 5y | 0.03 |

| Sharpe Ratio 12m | -0.06 |

| Alpha vs SP500 12m | -6.81 |

| Beta vs SP500 5y weekly | 0.38 |

| ValueRay RSI | 87.53 |

| Volatility GJR Garch 1y | 20.80% |

| Price / SMA 50 | 3.91% |

| Price / SMA 200 | 1.27% |

| Current Volume | 296.3k |

| Average Volume 20d | 506.5k |

External Links for ORAN Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of July 27, 2024, the stock is trading at USD 11.17 with a total of 296,277 shares traded.

Over the past week, the price has changed by +0.90%, over one month by +11.59%, over three months by +4.38% and over the past year by +5.48%.

According to ValueRays Forecast Model, ORAN Orange SA ADR will be worth about 12 in July 2025. The stock is currently trading at 11.17. This means that the stock has a potential upside of +7.25%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 13.8 | 23.5 |

| Analysts Target Price | 13.7 | 22.2 |

| ValueRay Target Price | 12 | 7.25 |