Solaris Oilfield Infrastructure (SOI)

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US83418M1036

Solaris Oilfield Infrastructure, Inc. is a company based in Houston, Texas, that specializes in designing and manufacturing mobile proppant management systems. These systems are vital for unloading, storing, and delivering proppant, water, and chemicals at oil and natural gas well sites across the United States.

Their expertise extends to transloading and storing proppant on railcars at their transloading facility, enabling efficient operations in the oil and natural gas industry. Besides these services, Solaris Oilfield Infrastructure, Inc. has also developed Railtronix, an advanced inventory management software to streamline processes.

In addition to their core offerings, the company provides innovative solutions such as AutoBlend, an integrated electric blender, top-fill equipment for quick unloading, fluid management systems, and their proprietary Solaris Lens software. These cutting-edge technologies cater to the needs of exploration and production companies as well as oilfield services industries.

Established in 2014, Solaris Oilfield Infrastructure, Inc. continues to be a prominent player in the sector, evolving with the ever-changing demands of the oil and natural gas market. To learn more, you can visit their website at https://www.solarisoilfield.com.

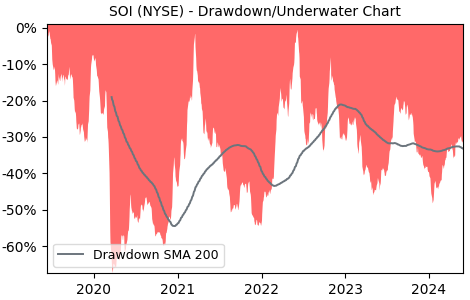

Drawdown (Underwater) Chart

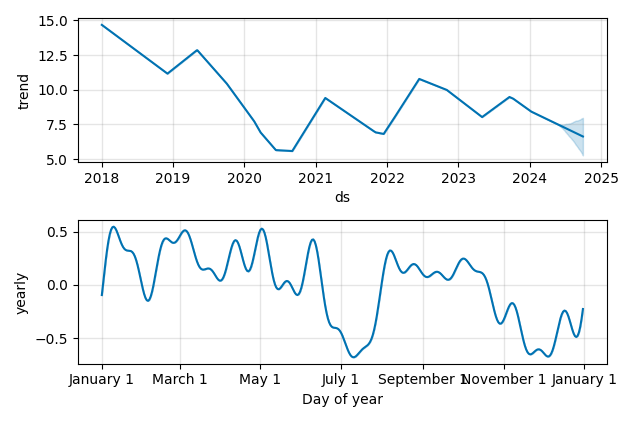

Overall Trend and Yearly Seasonality

SOI Stock Overview

| Market Cap in USD | 372m |

| Sector | Energy |

| Industry | Oil & Gas Equipment & Services |

| GiC SubIndustry | Oil & Gas Equipment & Services |

| TER | 0.00% |

| IPO / Inception | 2017-05-12 |

SOI Stock Ratings

| Growth 5y | -1.11 |

| Fundamental | 52.2 |

| Dividend | 6.28 |

| Rel. Performance vs Sector | 0.37 |

| Analysts | 4.33/5 |

| Fair Price Momentum | 8.06 USD |

| Fair Price DCF | 38.68 USD |

SOI Dividends

| Yield 12m | 5.08% |

| Yield on Cost 5y | 3.42% |

| Dividends CAGR 5y | 2.13% |

| Payout Consistency | 99.1% |

SOI Growth Ratios

| Growth 12m | 22.02% |

| Growth Correlation 12m | -9% |

| Growth Correlation 3m | 64% |

| CAGR 5y | -7.57% |

| Sharpe Ratio 12m | 0.41 |

| Alpha vs SP500 12m | -11.47 |

| Beta vs SP500 5y weekly | 1.29 |

| ValueRay RSI | 65.38 |

| Volatility GJR Garch 1y | 62.83% |

| Price / SMA 50 | 5.1% |

| Price / SMA 200 | 2.72% |

| Current Volume | 214.3k |

| Average Volume 20d | 328.2k |

External Links for SOI Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 09, 2024, the stock is trading at USD 9.06 with a total of 214,340 shares traded.

Over the past week, the price has changed by +2.14%, over one month by +1.12%, over three months by +22.46% and over the past year by +25.05%.

According to ValueRays Forecast Model, SOI Solaris Oilfield Infrastructure will be worth about 9 in May 2025. The stock is currently trading at 9.06. This means that the stock has a potential downside of -0.44%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 10.6 | 16.6 |

| Analysts Target Price | 0.2 | -97.5 |

| ValueRay Target Price | 9 | -0.44 |