SQ - Block - Stock Price & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US8522341036

Payment Processing, Point of Sale, Digital Wallets, Bitcoin, Stock Brokerage

Block, Inc., together with its subsidiaries, builds ecosystems focused on commerce and financial products and services in the United States and internationally. It operates through two segments, Square and Cash App. The Square segment offers commerce products for restaurants, appointments, retail, point of sale, online, online checkout, and invoices, as well as virtual terminals, risk and order managers, and payment and commerce application programming interfaces; managed payment services; software solutions; hardware products, such as registers, terminals, stands, and readers for contactless and chips; banking services consisting of lending, instant transfer, and checking and savings accounts; and full-service setup and support services. This segment also provides loyalty, marketing, team management, and payroll services; and gift cards. The Cash App segment offers financial tools within the mobile Cash App, including peer-to-peer payments, bitcoin, and stock investment brokerage; Cash App Card, a debit card; direct deposit, cash boost, and tax preparation services; and Afterpay, a buy now, pay later platform. This segment also provides Pay in 4, monthly payment solutions, advertising and affiliate, shop directory, and Cash App Pay services; and business accounts, and Afterpay and Afterpay Plus cards. In addition, the company operates TIDAL, a platform for musicians and fans; TBD, an open developer platform focused on making the decentralized financial world accessible; Bitkey, a self-custody bitcoin wallet; and Spiral, which focuses on bitcoin open source work. It serves businesses, sellers, and individuals through e-commerce and retail distribution channels. The company was formerly known as Square, Inc. and changed its name to Block, Inc. in December 2021. Block, Inc. was incorporated in 2009 and is based in Oakland, California. Web URL: https://www.block.xyz

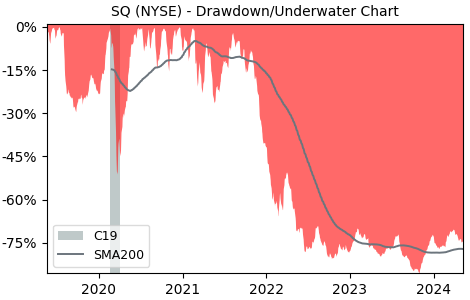

Drawdown (Underwater) Chart

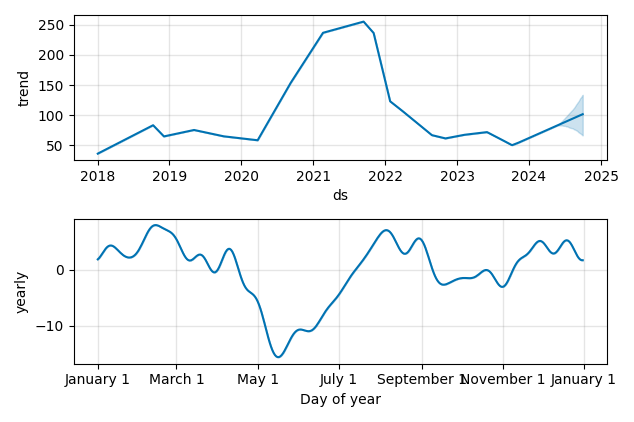

Overall Trend and Yearly Seasonality

SQ Stock Overview

| Market Cap in USD | 42,020m |

| Sector | Technology |

| Industry | Software - Infrastructure |

| GiC SubIndustry | Data Processing & Outsourced Services |

| TER | 0.00% |

| IPO / Inception | 2015-11-19 |

SQ Stock Ratings

| Growth 5y | -12.5 |

| Fundamental | -8.83 |

| Dividend | 0.00 |

| Rel. Performance vs Sector | -1.54 |

| Analysts | 4.26/5 |

| Fair Price Momentum | 51.72 USD |

| Fair Price DCF | 4.85 USD |

SQ Dividends

| Dividend Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

SQ Growth Ratios

| Growth 12m | -23.20% |

| Growth Correlation 12m | 28% |

| Growth Correlation 3m | -37% |

| CAGR 5y | -5.57% |

| CAGR/Mean DD 5y | -0.12 |

| Sharpe Ratio 12m | -0.58 |

| Alpha vs SP500 12m | -65.10 |

| Beta vs SP500 5y weekly | 2.37 |

| ValueRay RSI | 16.69 |

| Volatility GJR Garch 1y | 44.63% |

| Price / SMA 50 | -8.58% |

| Price / SMA 200 | -10.06% |

| Current Volume | 11387.9k |

| Average Volume 20d | 6650k |

External Links for SQ Stock

News

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

What is the price of SQ stocks?

As of July 27, 2024, the stock is trading at USD 60.18 with a total of 11,387,878 shares traded.

Over the past week, the price has changed by -11.63%, over one month by -4.91%, over three months by -19.20% and over the past year by -25.27%.

As of July 27, 2024, the stock is trading at USD 60.18 with a total of 11,387,878 shares traded.

Over the past week, the price has changed by -11.63%, over one month by -4.91%, over three months by -19.20% and over the past year by -25.27%.

What are the forecast for SQ stock price target?

According to ValueRays Forecast Model, SQ Block will be worth about 58.8 in July 2025. The stock is currently trading at 60.18. This means that the stock has a potential downside of -2.26%.

According to ValueRays Forecast Model, SQ Block will be worth about 58.8 in July 2025. The stock is currently trading at 60.18. This means that the stock has a potential downside of -2.26%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 90.1 | 49.8 |

| Analysts Target Price | 74.6 | 23.9 |

| ValueRay Target Price | 58.8 | -2.26 |