TPX - Tempur Sealy International - Stock & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US88023U1016

Mattresses, Pillows, Foundations, Adjustable Bases, Bedding Accessories

Tempur Sealy International Inc, a leading bedding products company, designs, manufactures, and distributes a wide range of sleep solutions globally. Its product portfolio includes mattresses, foundations, adjustable bases, and other comfort products, such as pillows, mattress covers, sheets, and cushions, all under its well-known brand names, including Tempur-Pedic, Sealy, Stearns & Foster, and Cocoon by Sealy.

The company operates a diverse sales network, comprising company-owned stores, online platforms, and call centers, as well as partnerships with third-party retailers, distributors, hospitality, and healthcare providers. This multi-channel approach enables Tempur Sealy to reach a broad customer base and cater to various consumer preferences.

In addition to its core business, Tempur Sealy International Inc also operates a portfolio of retail brands, including Tempur-Pedic retail stores, Sleep Outfitters, Sleep Solutions Outlet, Dreams, and SOVA. The company further licenses its brands, technology, and trademarks to other manufacturers, expanding its reach and influence in the bedding industry.

With a rich history dating back to 1846, Tempur Sealy International Inc is headquartered in Lexington, Kentucky, and continues to innovate and evolve to meet the changing needs of consumers. For more information, visit the company's website at https://www.tempursealy.com.

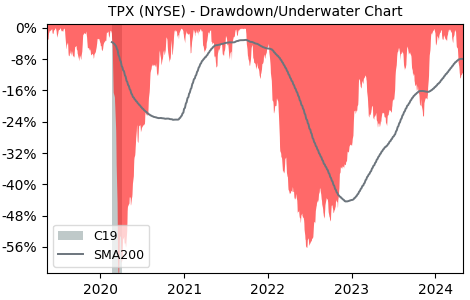

Drawdown (Underwater) Chart

TPX Stock Overview

| Market Cap in USD | 9,387m |

| Sector | Consumer Cyclical |

| Industry | Furnishings, Fixtures & Appliances |

| GiC SubIndustry | Home Furnishings |

| TER | 0.00% |

| IPO / Inception | 2003-12-18 |

TPX Stock Ratings

| Growth 5y | 69.5 |

| Fundamental | 20.4 |

| Dividend | 9.54 |

| Rel. Performance vs Sector | -0.11 |

| Analysts | 4.44/5 |

| Fair Price Momentum | 52.07 USD |

| Fair Price DCF | 66.46 USD |

TPX Dividends

| Dividend Yield 12m | 1.00% |

| Yield on Cost 5y | 2.57% |

| Dividends CAGR 5y | 11.20% |

| Payout Consistency | 20.6% |

TPX Growth Ratios

| Growth 12m | 26.41% |

| Growth Correlation 12m | 40.7% |

| Growth Correlation 3m | 30.9% |

| CAGR 5y | 20.65% |

| CAGR/Mean DD 5y | 1.20 |

| Sharpe Ratio 12m | 0.66 |

| Alpha vs SP500 12m | -26.81 |

| Beta vs SP500 5y weekly | 1.35 |

| ValueRay RSI | 13.20 |

| Volatility GJR Garch 1y | 26.74% |

| Price / SMA 50 | -3.58% |

| Price / SMA 200 | -2.45% |

| Current Volume | 1394.6k |

| Average Volume 20d | 1137.5k |

External Links for TPX Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of October 22, 2024, the stock is trading at USD 49.82 with a total of 1,394,610 shares traded.

Over the past week, the price has changed by -1.56%, over one month by -7.35%, over three months by -2.63% and over the past year by +26.32%.

According to ValueRays Forecast Model, TPX Tempur Sealy International will be worth about 57.5 in October 2025. The stock is currently trading at 49.82. This means that the stock has a potential upside of +15.36%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 58.4 | 17.2 |

| Analysts Target Price | 51 | 2.37 |

| ValueRay Target Price | 57.5 | 15.4 |