Understanding U.S. Bancorp: From Its Roots to Today

U.S. Bancorp, with its ticker symbol NYSE:USB-PH, has an illustrious history that traces back to 1863. Originating as the First National Bank of Cincinnati, it transformed through numerous mergers and acquisitions to become the fifth-largest bank in the United States today. This path wasn't just about expanding its footprint; it was about evolving with the times to meet the changing needs of its customers.

The Core of U.S. Bancorp

At its core, U.S. Bancorp is a comprehensive financial services company. It offers a variety of services including banking, investment, mortgage, trust, and payment services products to individuals, businesses, governmental entities, and other financial institutions. Its approach to banking is customer-centric, aiming to provide high-quality service coupled with a wide range of products.

Diverse Yet Focused Side Businesses

Beyond its primary banking services, U.S. Bancorp has developed a robust portfolio of side businesses. These include payment solutions such as credit and debit card processing, ATM processing, and merchant acquiring services. Additionally, the company has a significant presence in wealth management and securities services, providing customized solutions to meet the varied needs of its clients.

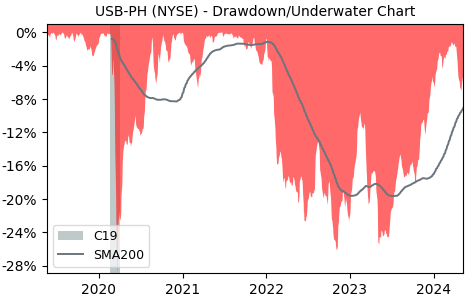

Current Market Status

As of the latest information available up to 2023, U.S. Bancorp continues to hold a strong position in the market. It remains a leader in the banking sector, with a solid reputation for reliability and customer service. The company's strategic acquisitions and focus on technological innovation have helped it maintain a competitive edge. Financially, it has shown resilience and growth, even in the face of economic fluctuations, making it a stable choice for investors and customers alike.