WFC-PL - Wells Fargo & Company - Stock & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Preferred Stock • ISIN: -s

Banking, Investment, Mortgage, Lending, CreditCards

Wells Fargo & Company is a multinational financial services company that offers a wide range of financial products and services to consumers, small businesses, corporations, and institutions. With a rich history dating back to 1852, the company operates through four main segments that cater to different markets and needs.

The Consumer Banking and Lending segment provides a variety of financial products and services for consumers and small businesses. These products and services include checking and savings accounts, credit and debit cards, home, auto, personal, and small business lending services. This segment aims to help individuals and small businesses manage their finances and achieve their goals.

The Commercial Banking segment provides financial solutions to private companies, family-owned businesses, and public companies. The products and services offered include banking and credit products, secured lending and lease products, and treasury management services. This segment helps businesses to manage their finances, increase cash flow, and achieve their business goals.

The Corporate and Investment Banking segment offers a range of capital markets, banking, and financial products and services. These products and services include corporate banking, investment banking, treasury management, commercial real estate lending and servicing, equity, and fixed income solutions. This segment also provides sales, trading, and research capabilities to corporate, commercial real estate, government, and institutional clients. The Corporate and Investment Banking segment aims to help large businesses and institutions achieve their financial goals.

The Wealth and Investment Management segment provides personalized wealth management, brokerage, financial planning, lending, private banking, and trust and fiduciary products and services to affluent, high-net worth, and ultra-high-net worth clients. The segment operates through financial advisors in brokerage and wealth offices, consumer bank branches, independent offices, and digitally through WellsTrade and Intuitive Investor. This segment helps high-net worth individuals to manage their wealth and achieve their financial goals.

Wells Fargo & Company operates internationally and has its headquarters in San Francisco, California. The company's mission is to provide excellent customer service and to help its customers achieve their financial goals.

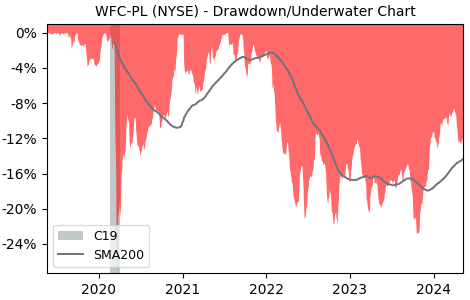

Drawdown (Underwater) Chart

WFC-PL Stock Overview

| Market Cap in USD | 185,986m |

| Sector | Financial Services |

| Industry | Banks - Diversified |

| GiC SubIndustry | Regional Banks |

| TER | 0.00% |

| IPO / Inception |

WFC-PL Stock Ratings

| Growth 5y | 15.9 |

| Fundamental | -10.4 |

| Dividend | 50.2 |

| Rel. Performance vs Sector | -0.92 |

| Analysts | - |

| Fair Price Momentum | 1179.62 USD |

| Fair Price DCF | 116.64 USD |

WFC-PL Dividends

| Dividend Yield 12m | 6.30% |

| Yield on Cost 5y | 7.21% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 97.5% |

WFC-PL Growth Ratios

| Growth 12m | 9.07% |

| Growth Correlation 12m | 59% |

| Growth Correlation 3m | 82% |

| CAGR 5y | 2.74% |

| CAGR/Mean DD 5y | 0.27 |

| Sharpe Ratio 12m | 0.34 |

| Alpha vs SP500 12m | -5.77 |

| Beta vs SP500 5y weekly | 0.61 |

| ValueRay RSI | 25.46 |

| Volatility GJR Garch 1y | 9.44% |

| Price / SMA 50 | 0.85% |

| Price / SMA 200 | 4.38% |

| Current Volume | 4.5k |

| Average Volume 20d | 5.9k |

External Links for WFC-PL Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of July 27, 2024, the stock is trading at USD 1191.11 with a total of 4,487 shares traded.

Over the past week, the price has changed by -0.74%, over one month by +0.62%, over three months by +4.80% and over the past year by +7.77%.

According to ValueRays Forecast Model, WFC-PL Wells Fargo & Company will be worth about 1277.3 in July 2025. The stock is currently trading at 1191.11. This means that the stock has a potential upside of +7.24%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 1277.3 | 7.24 |