The History of Wells Fargo & Company

Wells Fargo & Company, a name synonymous with American banking and financial services, began its journey in 1852. Founded by Henry Wells and William Fargo in New York, it was established to cater to the banking and express needs of the Gold Rush pioneers in California. The company quickly made a name for itself by providing dependable banking, express, and mail services across the western U.S., navigating the challenges of a rapidly expanding nation.

Core and Side Businesses

At its core, Wells Fargo operates as a diversified financial services company. It offers a broad spectrum of banking, insurance, investments, mortgage, and consumer and commercial finance products and services. Notably, it serves one in three U.S. households and occupies a substantial presence in the online banking realm.

Beyond its primary banking operation, Wells Fargo has dipped its toes in several side ventures and segments. These include wealth management, securities brokerage, and retirement services. Moreover, the company has made strategic investments in technological innovations to streamline financial transactions and customer services, marking its foray into the fintech domain.

Current Market Status

As of the latest assessments, Wells Fargo remains one of the largest banks in the United States by total assets. Despite facing regulatory challenges and reputational hits in the past, the company is making strides in rebuilding its image and refocusing on core operations. It has been actively divesting from non-core businesses and implementing strategies aimed at enhancing customer satisfaction and operational efficiency.

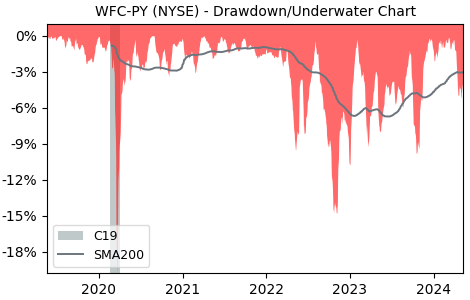

The market status of Wells Fargo thus reflects a period of transition and recovery, with a keen emphasis on leveraging technology and enhancing its service offerings. With its share listed on the New York Stock Exchange under the ticker NYSE:WFC-PY, the bank continues to be a significant player in the global financial landscape, closely watched by investors and industry analysts alike.