SILV - SilverCrest Metals - Stock Price & Dividends

Exchange: USA Stocks • Country: Canada • Currency: USD • Type: Common Stock • ISIN: CA8283631015

Silver, Gold

SilverCrest Metals Inc. is a Canadian-based mining company that specializes in acquiring, exploring, and developing precious metal properties in Mexico, with a primary focus on silver and gold deposits.

The company's flagship project is the Las Chispas Mine, which consists of 28 concessions spanning approximately 1,401 hectares in Sonora, Mexico. This property has significant potential for silver and gold discoveries, and SilverCrest Metals is committed to unlocking its full value.

In addition to Las Chispas, the company operates a diversified portfolio of properties in Sonora, Mexico, including El Picacho, Cruz de Mayo, and Angel de Plata. These properties offer further opportunities for exploration and development, allowing SilverCrest Metals to expand its presence in the region.

With its incorporation in 2015, SilverCrest Metals has established itself as a key player in the Mexican mining industry, leveraging its expertise and resources to drive growth and discovery. The company's headquarters are located in Vancouver, Canada, providing access to a robust mining ecosystem and network of industry experts.

For more information on SilverCrest Metals Inc. and its projects, please visit their website at https://www.silvercrestmetals.com.

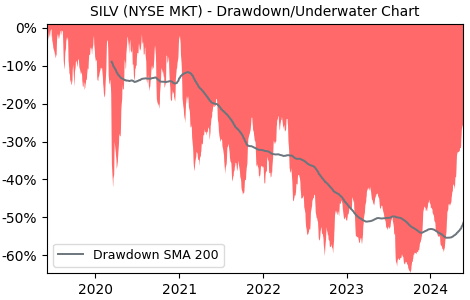

Drawdown (Underwater) Chart

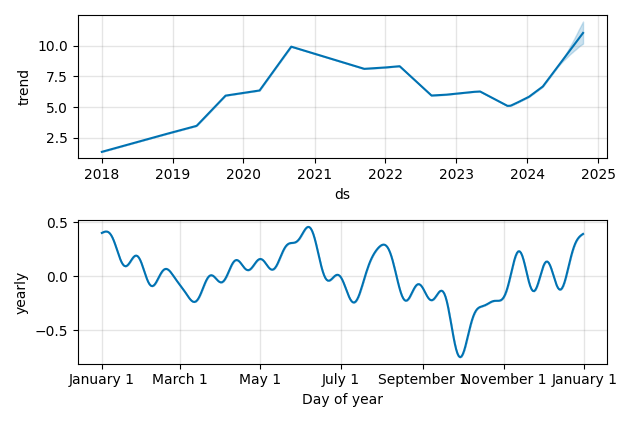

Overall Trend and Yearly Seasonality

SILV Stock Overview

| Market Cap in USD | 1,318m |

| Sector | Basic Materials |

| Industry | Other Precious Metals & Mining |

| GiC SubIndustry | Precious Metals & Minerals |

| TER | 0.00% |

| IPO / Inception | 2015-10-26 |

SILV Stock Ratings

| Growth 5y | 23.5 |

| Fundamental | 86.7 |

| Dividend | 0.00 |

| Rel. Performance vs Sector | 4.13 |

| Analysts | 3.63/5 |

| Fair Price Momentum | 8.82 USD |

| Fair Price DCF | 13.33 USD |

SILV Dividends

| Dividend Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

SILV Growth Ratios

| Growth 12m | 66.18% |

| Growth Correlation 12m | 71% |

| Growth Correlation 3m | 19% |

| CAGR 5y | 11.65% |

| CAGR/Mean DD 5y | 0.35 |

| Sharpe Ratio 12m | 1.20 |

| Alpha vs SP500 12m | 50.20 |

| Beta vs SP500 5y weekly | 0.69 |

| ValueRay RSI | 43.47 |

| Volatility GJR Garch 1y | 49.96% |

| Price / SMA 50 | 3.86% |

| Price / SMA 200 | 33.43% |

| Current Volume | 827.8k |

| Average Volume 20d | 1310.9k |

External Links for SILV Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of July 27, 2024, the stock is trading at USD 9.14 with a total of 827,778 shares traded.

Over the past week, the price has changed by +0.00%, over one month by +9.99%, over three months by +7.15% and over the past year by +59.23%.

According to ValueRays Forecast Model, SILV SilverCrest Metals will be worth about 9.8 in July 2025. The stock is currently trading at 9.14. This means that the stock has a potential upside of +6.67%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 8 | -12.5 |

| Analysts Target Price | 7.5 | -17.9 |

| ValueRay Target Price | 9.8 | 6.67 |