CEZ - Cez A.S. - Stock Price & Dividends

Exchange: Prague Stock Exchange • Country: Czech Republic • Currency: CZK • Type: Common Stock • ISIN: CZ0005112300

Electricity, Heat, Natural Gas, Coal, Renewable Energy

CEZ, a.s. is a leading energy company in Europe, operating in the generation, distribution, trade, and sale of electricity and heat across Western, Central, and Southeastern Europe. The company's diversified portfolio includes various types of power plants, such as hydro, wind, solar, nuclear, coal, natural gas, biogas, and biomass facilities, as well as combined cycle gas turbine plants and small combined heat and power units.

CEZ, a.s. operates through four distinct segments: Generation, Distribution, Sales, and Mining. The Generation segment focuses on producing electricity from various energy sources, while the Distribution segment is responsible for transmitting and delivering electricity to end-users. The Sales segment handles the trade and sale of electricity, natural gas, and other energy-related products. The Mining segment, on the other hand, is involved in the extraction of coal, limestone, and other minerals.

In addition to its core energy business, CEZ, a.s. is also engaged in various other activities, including commodity trading, energy services, and the mining of lithium ore. The company has a significant interest in the Cínovec lithium ore mining project, which is expected to play a crucial role in the production of lithium-ion batteries for electric vehicles and other applications.

Headquartered in Prague, the Czech Republic, CEZ, a.s. has a long history dating back to 1992. With a strong presence in the European energy market, the company continues to expand its operations and invest in new technologies to meet the growing demand for clean and sustainable energy. For more information, please visit the company's website at https://www.cez.cz.

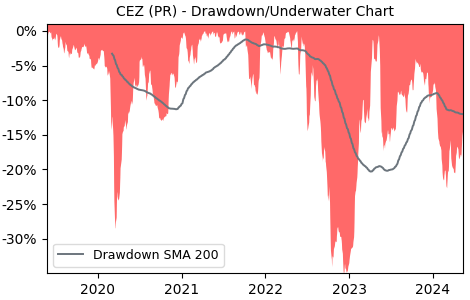

Drawdown (Underwater) Chart

CEZ Stock Overview

| Market Cap in USD | 20,540m |

| Sector | Utilities |

| Industry | Utilities - Renewable |

| GiC SubIndustry | Renewable Electricity |

| TER | 0.00% |

| IPO / Inception |

CEZ Stock Ratings

| Growth 5y | 72.3 |

| Fundamental | 27.5 |

| Dividend | 82.6 |

| Rel. Performance vs Sector | -0.94 |

| Analysts | - |

| Fair Price Momentum | 986.07 CZK |

| Fair Price DCF | 4869.67 CZK |

CEZ Dividends

| Dividend Yield 12m | 5.74% |

| Yield on Cost 5y | 14.99% |

| Dividends CAGR 5y | 43.30% |

| Payout Consistency | 93.5% |

CEZ Growth Ratios

| Growth 12m | 1.90% |

| Growth Correlation 12m | -25% |

| Growth Correlation 3m | 64% |

| CAGR 5y | 21.21% |

| CAGR/Mean DD 5y | 2.36 |

| Sharpe Ratio 12m | -0.19 |

| Alpha vs SP500 12m | -7.34 |

| Beta vs SP500 5y weekly | 0.25 |

| ValueRay RSI | 56.93 |

| Volatility GJR Garch 1y | 15.11% |

| Price / SMA 50 | 1.76% |

| Price / SMA 200 | 4.25% |

| Current Volume | 119.3k |

| Average Volume 20d | 128.7k |

External Links for CEZ Stock

As of July 27, 2024, the stock is trading at CZK 906.00 with a total of 119,270 shares traded.

Over the past week, the price has changed by -0.55%, over one month by +2.83%, over three months by +13.06% and over the past year by +0.14%.

According to ValueRays Forecast Model, CEZ Cez A.S. will be worth about 1068 in July 2025. The stock is currently trading at 906.00. This means that the stock has a potential upside of +17.88%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 812.3 | -10.3 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 1068 | 17.9 |