3V64 - Visa - Stock Price & Dividends

Exchange: XETRA Stock Exchange • Country: United States • Currency: EUR • Type: Common Stock • ISIN: US92826C8394

Credit Cards, Debit Cards, Prepaid Cards, Payment Solutions

Visa Inc. is a leading payment technology company that operates globally, facilitating transactions between consumers, merchants, financial institutions, and government entities.

The company's core infrastructure is built around VisaNet, a robust transaction processing network that enables secure, efficient, and reliable authorization, clearing, and settlement of payment transactions.

Visa offers a diverse range of payment products and services, including credit, debit, and prepaid cards, as well as innovative solutions such as tap-to-pay, tokenization, and click-to-pay. Additionally, the company provides Visa Direct, a solution that enables fast and secure delivery of funds to eligible cards, deposit accounts, and digital wallets.

For businesses, Visa offers a suite of solutions, including Visa B2B Connect, a multilateral business-to-business cross-border payments network, and Visa Cross-Border Solution, a cross-border consumer payments solution. The company also provides Visa DPS, which offers a range of value-added services, including fraud mitigation, dispute management, data analytics, campaign management, digital solutions, and contact center services.

Visa's acceptance solutions include Cybersource, which provides modular and value-added services for connecting merchants to payment processing. The company also offers risk and identity solutions, such as Visa Advanced Authorization, Visa Secure, Visa Risk and Decision Manager, and Visa Consumer Authentication Service, to help prevent fraud and ensure secure transactions.

Furthermore, Visa Consulting and Analytics provides payment consulting advisory services to help businesses optimize their payment strategies. The company operates under various brand names, including Visa, Visa Electron, Interlink, V PAY, and PLUS, and serves a diverse range of clients, from small businesses to large corporations and government entities.

Founded in 1958, Visa Inc. is headquartered in San Francisco, California, and has established itself as a leader in the digital payments industry, with a strong commitment to innovation, security, and customer satisfaction.

For more information, visit Visa's official website at https://www.visa.com.

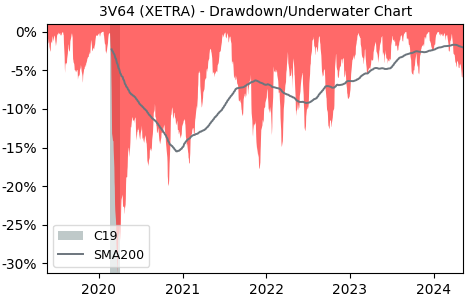

Drawdown (Underwater) Chart

3V64 Stock Overview

| Market Cap in USD | 571,859m |

| Sector | Financial Services |

| Industry | Credit Services |

| GiC SubIndustry | Consumer Finance |

| TER | 0.00% |

| IPO / Inception |

3V64 Stock Ratings

| Growth 5y | 68.2 |

| Fundamental | 58.2 |

| Dividend | 54.2 |

| Rel. Performance vs Sector | -2.10 |

| Analysts | - |

| Fair Price Momentum | 267.93 EUR |

| Fair Price DCF | 283.16 EUR |

3V64 Dividends

| Dividend Yield 12m | 0.71% |

| Yield on Cost 5y | 1.24% |

| Dividends CAGR 5y | 12.24% |

| Payout Consistency | 99.7% |

3V64 Growth Ratios

| Growth 12m | 22.83% |

| Growth Correlation 12m | 35.6% |

| Growth Correlation 3m | 77.3% |

| CAGR 5y | 11.56% |

| CAGR/Mean DD 5y | 1.68 |

| Sharpe Ratio 12m | 1.09 |

| Alpha vs SP500 12m | -9.69 |

| Beta vs SP500 5y weekly | 0.77 |

| ValueRay RSI | 86.57 |

| Volatility GJR Garch 1y | 15.78% |

| Price / SMA 50 | 5.61% |

| Price / SMA 200 | 5.34% |

| Current Volume | 0.7k |

| Average Volume 20d | 1.7k |

External Links for 3V64 Stock

As of October 22, 2024, the stock is trading at EUR 265.15 with a total of 733 shares traded.

Over the past week, the price has changed by +3.11%, over one month by +3.92%, over three months by +8.71% and over the past year by +22.27%.

According to ValueRays Forecast Model, 3V64 Visa will be worth about 294.8 in October 2025. The stock is currently trading at 265.15. This means that the stock has a potential upside of +11.16%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 294.8 | 11.2 |