ABEA - Alphabet Class A - Stock Price & Dividends

Exchange: XETRA Stock Exchange • Country: United States • Currency: EUR • Type: Common Stock • ISIN: US02079K3059

Search, Ads, Cloud, Devices, Maps, Email, Workspace

Alphabet Inc., the parent company of Google, is a multinational conglomerate that operates a diverse range of businesses across the globe, spanning the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

The company's Google Services segment is the backbone of its operations, offering a wide array of products and services that have become an integral part of daily life. These include advertising solutions, the Android operating system, the Chrome browser, devices such as Pixel smartphones and Chromebook laptops, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube. Additionally, this segment generates revenue from the sale of apps and in-app purchases, as well as digital content on Google Play and YouTube, and from devices and YouTube consumer subscription services.

The Google Cloud segment is a key growth driver for the company, providing a suite of services that enable businesses to operate more efficiently and securely. These services include infrastructure, cybersecurity, databases, analytics, artificial intelligence, and more. The segment also offers Google Workspace, a cloud-based platform that provides communication and collaboration tools for enterprises, including Gmail, Docs, Drive, Calendar, and Meet. This platform helps businesses streamline their operations, enhance productivity, and reduce costs.

The Other Bets segment is a collection of innovative businesses that operate outside of the company's core Google Services and Google Cloud segments. This segment includes healthcare-related businesses, such as Verily and Calico, which focus on developing new healthcare technologies and solutions. It also includes internet services, such as Fiber, which provides high-speed internet and TV services to consumers.

Founded in 1998, Alphabet Inc. is headquartered in Mountain View, California, and has grown to become one of the world's largest and most influential technology companies. For more information, visit the company's website at https://abc.xyz.

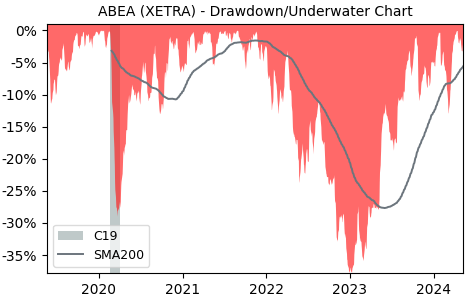

Drawdown (Underwater) Chart

ABEA Stock Overview

| Market Cap in USD | 2,055,376m |

| Sector | Communication Services |

| Industry | Internet Content & Information |

| GiC SubIndustry | Interactive Media & Services |

| TER | 0.00% |

| IPO / Inception |

ABEA Stock Ratings

| Growth 5y | 85.2 |

| Fundamental | 50.2 |

| Dividend | 13.8 |

| Rel. Performance vs Sector | -0.93 |

| Analysts | - |

| Fair Price Momentum | 161.80 EUR |

| Fair Price DCF | 258.82 EUR |

ABEA Dividends

| Dividend Yield 12m | 0.24% |

| Yield on Cost 5y | 0.65% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 100.0% |

ABEA Growth Ratios

| Growth 12m | 31.04% |

| Growth Correlation 12m | 73.8% |

| Growth Correlation 3m | -5.3% |

| CAGR 5y | 21.23% |

| CAGR/Mean DD 5y | 2.03 |

| Sharpe Ratio 12m | 0.99 |

| Alpha vs SP500 12m | -3.27 |

| Beta vs SP500 5y weekly | 0.82 |

| ValueRay RSI | 60.29 |

| Volatility GJR Garch 1y | 27.16% |

| Price / SMA 50 | 2.81% |

| Price / SMA 200 | 1.7% |

| Current Volume | 20.5k |

| Average Volume 20d | 26k |

External Links for ABEA Stock

As of October 22, 2024, the stock is trading at EUR 150.56 with a total of 20,517 shares traded.

Over the past week, the price has changed by +0.00%, over one month by +3.17%, over three months by -9.23% and over the past year by +28.63%.

According to ValueRays Forecast Model, ABEA Alphabet Class A will be worth about 178.6 in October 2025. The stock is currently trading at 150.56. This means that the stock has a potential upside of +18.61%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 178.6 | 18.6 |