Linde PLC: Navigating Through Time and Markets

Linde PLC, now a household name in the industrial gas sector, has roots tracing back to the late 19th century. Founded in 1879 by Carl von Linde, an engineer whose innovations in refrigeration technology laid the company's foundation, Linde has grown into a global leader in the production and distribution of industrial gases.

The Core Business

At its core, Linde is focused on the large-scale production of industrial gases such as oxygen, nitrogen, argon, and a host of others. These gases play critical roles in various industries, including healthcare, where oxygen is vital; the food industry, where gases are used for refrigeration and preservation; and the technology sector, where special gases are necessary for manufacturing processes.

Expanding Beyond the Core

Beyond its primary focus, Linde has diversified into related areas. One such area is engineering, where Linde designs and builds equipment and plants for the gas industry, leveraging its extensive experience to deliver high-efficiency solutions. Additionally, Linde holds a strong position in developing environmentally friendly technologies, focusing on clean hydrogen and carbon capture systems, areas expected to see significant growth in response to global sustainability efforts.

The Current Market Status

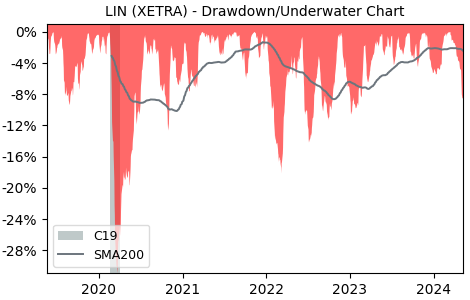

As of my last update in 2023, Linde PLC (XETRA:LIN) remains a formidable player in the global market. Mergers and acquisitions, notably with Praxair in 2018, have expanded its global footprint and solidified its market position. Financially, Linde has shown resilience and growth, demonstrating strong performance in revenues and stock market presence. The company continues to innovate, focusing on sustainable industrial gas supply and technologies, which places it well in the trend towards green energy and emission reduction goals.

Linde's journey from a 19th-century refrigeration pioneer to a 21st-century industrial and environmental leader showcases its ability to adapt and grow. With a clear focus on innovation, sustainability, and market expansion, Linde PLC stands out as a robust entity in today's global economy.