NVD - NVIDIA - Stock Price & Dividends

Exchange: XETRA Stock Exchange • Country: United States • Currency: EUR • Type: Common Stock • ISIN: US67066G1040

GPUs, Software, Platforms, Services

NVIDIA Corporation is a leading provider of innovative technologies that power the world of graphics, computing, and networking. With a strong presence in the United States, Taiwan, China, Hong Kong, and internationally, the company offers a wide range of solutions that cater to various industries, including gaming, professional visualization, data center, and automotive.

The company's Graphics segment is a powerhouse of creativity, offering GeForce GPUs that enable gamers to experience stunning visuals and performance on their PCs and gaming consoles. The GeForce NOW game streaming service allows gamers to access their favorite games on any device, without the need for a high-end gaming PC. Additionally, NVIDIA's Quadro/NVIDIA RTX GPUs provide enterprise workstation graphics solutions that help professionals in fields like architecture, engineering, and design to create and visualize complex projects. The company's vGPU software enables cloud-based visual and virtual computing, making it possible for users to access high-performance graphics capabilities from anywhere.

NVIDIA's Compute & Networking segment is focused on providing solutions for the data center and automotive industries. The company's Data Center computing platforms and end-to-end networking platforms, including Quantum for InfiniBand and Spectrum for Ethernet, enable fast and secure data transfer and processing. The NVIDIA DRIVE automated-driving platform is a key component of the company's automotive solutions, which also include development agreements with leading automotive manufacturers. Jetson robotics and other embedded platforms provide the necessary technologies for building intelligent robots and other autonomous systems. NVIDIA AI Enterprise and other software solutions help businesses to develop and deploy AI-powered applications. DGX Cloud software and services provide a cloud-based platform for data center and AI applications.

NVIDIA's products are used by a wide range of customers, including original equipment manufacturers, original device manufacturers, system integrators and distributors, independent software vendors, cloud service providers, consumer internet companies, add-in board manufacturers, distributors, automotive manufacturers and tier-1 automotive suppliers, and other ecosystem participants. The company's products are available through various channels, including its website, authorized distributors, and retail partners.

NVIDIA Corporation was founded in 1993 and is headquartered in Santa Clara, California. The company has established itself as a leader in the technology industry, known for its innovative products and solutions that have transformed the way people live, work, and play. With a strong commitment to research and development, NVIDIA continues to push the boundaries of what is possible in the world of technology.

For more information about NVIDIA Corporation, visit their website at https://www.nvidia.com.

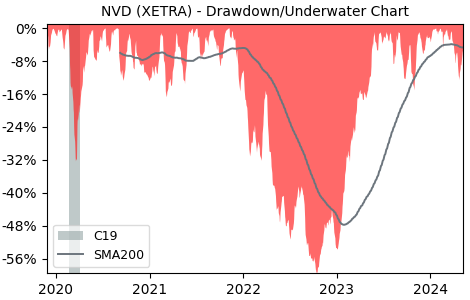

Drawdown (Underwater) Chart

Overall Trend and Yearly Seasonality

NVD Stock Overview

| Market Cap in USD | 3,290,865m |

| Sector | Technology |

| Industry | Semiconductors |

| GiC SubIndustry | Semiconductors |

| TER | 0.00% |

| IPO / Inception |

NVD Stock Ratings

| Growth 5y | 91.5 |

| Fundamental | 87.6 |

| Dividend | 31.4 |

| Rel. Performance vs Sector | 4.05 |

| Analysts | - |

| Fair Price Momentum | 168.44 EUR |

| Fair Price DCF | 34.58 EUR |

NVD Dividends

| Dividend Yield 12m | 0.02% |

| Yield on Cost 5y | 0.42% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 98.5% |

NVD Growth Ratios

| Growth 12m | 159.82% |

| Growth Correlation 12m | 81% |

| Growth Correlation 3m | 59% |

| CAGR 5y | 91.98% |

| CAGR/Mean DD 5y | 6.16 |

| Sharpe Ratio 12m | 3.59 |

| Alpha vs SP500 12m | 131.71 |

| Beta vs SP500 5y weekly | 1.49 |

| ValueRay RSI | 2.91 |

| Volatility GJR Garch 1y | 49.66% |

| Price / SMA 50 | -5.32% |

| Price / SMA 200 | 43.05% |

| Current Volume | 1199.4k |

| Average Volume 20d | 434k |

External Links for NVD Stock

As of July 27, 2024, the stock is trading at EUR 105.40 with a total of 1,199,369 shares traded.

Over the past week, the price has changed by -2.12%, over one month by -9.36%, over three months by +39.01% and over the past year by +157.63%.

According to ValueRays Forecast Model, NVD NVIDIA will be worth about 189.6 in July 2025. The stock is currently trading at 105.40. This means that the stock has a potential upside of +79.86%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 189.6 | 79.9 |