OPC - Occidental Petroleum - Stock & Dividends

Exchange: XETRA Stock Exchange • Country: United States • Currency: EUR • Type: Common Stock • ISIN: US6745991058

Oil, Natural Gas, Chemicals, Petrochemicals

Occidental Petroleum Corporation is a leading energy company that explores, develops, and produces oil and gas properties across the United States, the Middle East, and North Africa. Through its subsidiaries, the company operates three main business segments.

The Oil and Gas segment is responsible for finding and extracting oil, condensate, natural gas liquids (NGLs), and natural gas from the ground. This involves drilling and operating wells, as well as maintaining and improving existing infrastructure to optimize production.

In addition to its oil and gas operations, Occidental Petroleum Corporation has a significant Chemical segment that manufactures and markets a range of basic chemicals. These include essential products like chlorine, caustic soda, and vinyls, which are used in various industries such as construction, manufacturing, and water treatment. The company's chemical products are also used in the production of plastics, pharmaceuticals, and other consumer goods.

The Midstream and Marketing segment plays a critical role in the company's operations, as it gathers, processes, transports, and stores oil, condensate, NGLs, natural gas, and other energy products. This segment also markets these products to customers, as well as invests in other energy-related entities to further expand its reach.

With a rich history dating back to 1920, Occidental Petroleum Corporation has established itself as a major player in the global energy industry. Headquartered in Houston, Texas, the company continues to drive innovation and growth, with a strong commitment to safety, sustainability, and community engagement. For more information, visit their website at https://www.oxy.com.

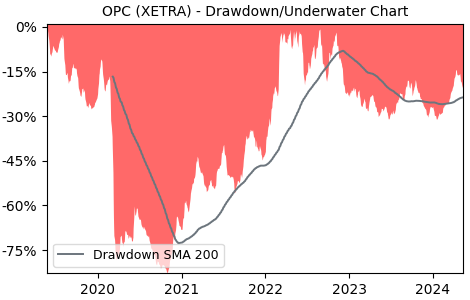

Drawdown (Underwater) Chart

OPC Stock Overview

| Market Cap in USD | 56,238m |

| Sector | Energy |

| Industry | Oil & Gas E&P |

| GiC SubIndustry | Oil & Gas Exploration & Production |

| TER | 0.00% |

| IPO / Inception |

OPC Stock Ratings

| Growth 5y | 37.3 |

| Fundamental | 32.9 |

| Dividend | 29.8 |

| Rel. Performance vs Sector | -0.39 |

| Analysts | - |

| Fair Price Momentum | 53.65 EUR |

| Fair Price DCF | 147.15 EUR |

OPC Dividends

| Dividend Yield 12m | 1.33% |

| Yield on Cost 5y | 2.30% |

| Dividends CAGR 5y | -1.84% |

| Payout Consistency | 84.1% |

OPC Growth Ratios

| Growth 12m | -0.85% |

| Growth Correlation 12m | 0% |

| Growth Correlation 3m | -27% |

| CAGR 5y | 12.27% |

| CAGR/Mean DD 5y | 0.38 |

| Sharpe Ratio 12m | -0.27 |

| Alpha vs SP500 12m | -25.98 |

| Beta vs SP500 5y weekly | 1.28 |

| ValueRay RSI | 21.00 |

| Volatility GJR Garch 1y | 18.21% |

| Price / SMA 50 | -2.7% |

| Price / SMA 200 | -2.22% |

| Current Volume | 0.6k |

| Average Volume 20d | 1.8k |

External Links for OPC Stock

As of July 27, 2024, the stock is trading at EUR 55.42 with a total of 644 shares traded.

Over the past week, the price has changed by -5.26%, over one month by -5.09%, over three months by -11.96% and over the past year by -3.65%.

According to ValueRays Forecast Model, OPC Occidental Petroleum will be worth about 59 in July 2025. The stock is currently trading at 55.42. This means that the stock has a potential upside of +6.41%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 59 | 6.41 |